Introduction

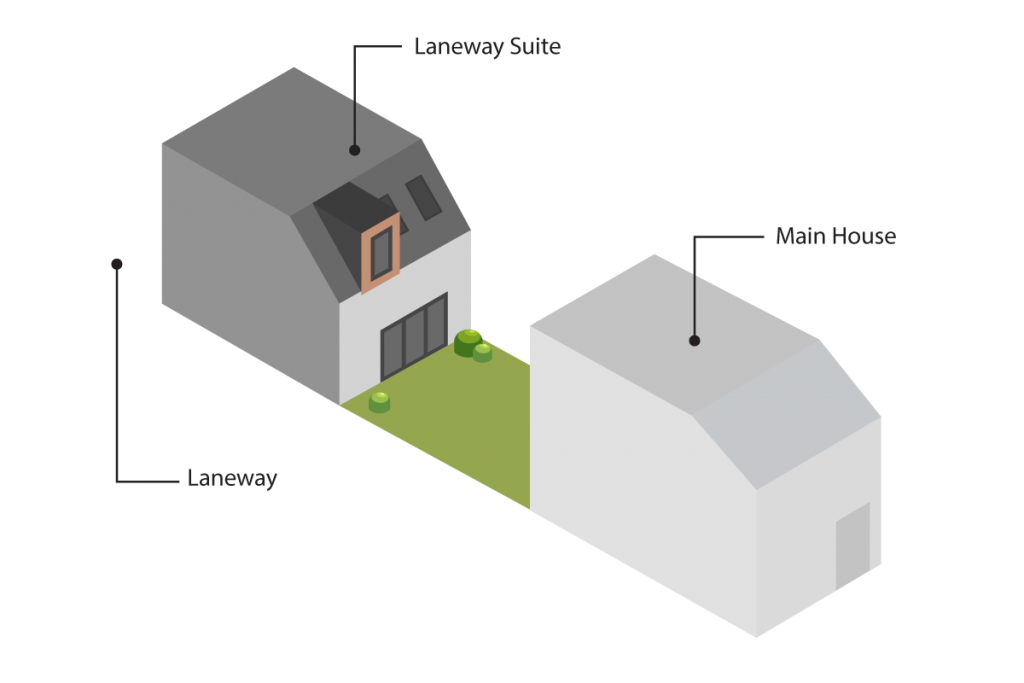

Laneway suites in Toronto have become a popular option for homeowners looking to add additional living space and income potential to their property.

However, determining the value of a laneway suite can be a bit tricky, even for appraisers, as there are several factors to consider.

The Market Cap Rate Method

One method that is commonly used to value rental properties is the capitalization rate (cap rate). In this blog post, we will discuss how to use cap rate to value a laneway suite in Toronto.

What is a Cap Rate?

The cap rate is a measure of the return on investment (ROI) of a rental property. The cap rate calculated by dividing the net operating income (NOI) by the current market value of the property.

The cap rate is often used to compare properties and determine which one is a better investment. A higher cap rate indicates a higher ROI, while a lower cap rate indicates a lower ROI.

How to Use The Market Cap Rate to Value a Laneway Suite

To use cap rate to value a laneway suite, you will need to determine the annual net operating income (NOI) and the current market value of comparable units.

The NOI is calculated by subtracting the annual operating expenses (such as property taxes, insurance, and maintenance) from the annual rents collected.

Once you have determined the NOI, you can divide it by the market cap rate to find the approximate market value of your laneway suite.

Example

For example, if the laneway suite has an annual NOI of $36,000 and a cap rate of 6%, the current market value of the laneway suite build would be $600,000 ($36,000 ÷ 0.06).

It’s important to keep in mind that the cap rate can vary depending on the location, the condition of the property, and the current real estate market.

The Market Comparables Method

Another common method to value a property, including a laneway suite, is by using market comparables.

Market comparables, also known as “comps,” are properties that are similar to the one being valued in terms of location, size, and amenities. The value of these comparable properties is then used as a benchmark to estimate the value of the subject property.

To use market comparables to value a laneway suite, you will need to find properties that are similar to the suite in terms of location, size, and amenities, such as freehold towns. You can find these comparables by searching online real estate listings or consulting with a real estate agent.

Once you have found several comparables, you can compare the sale prices or the rental rates of these properties to the subject property to estimate its value.

It’s important to keep in mind that the comparable properties should be as similar as possible to the subject property, and that the market conditions at the time of the sale or rental should be taken into account.

Additionally, it’s also important to consider the condition of the property and any unique features or amenities that might affect the value.

How We Can Help

Valuating a laneway suite can be challenging because they are a relatively new type of property.

Furthermore, the market trends of laneway suites are not as clear as other types of properties and can be hard to track.

If you want to learn more about how to value a laneway suite in Toronto, we’re happy to chat. Contact us today to schedule a consultation!

Want To See If You Qualify For A Laneway Suite or Garden Suite Build In Toronto?